Data Dig: Shady Money Moves in Long Beach City Council Campaign Donations

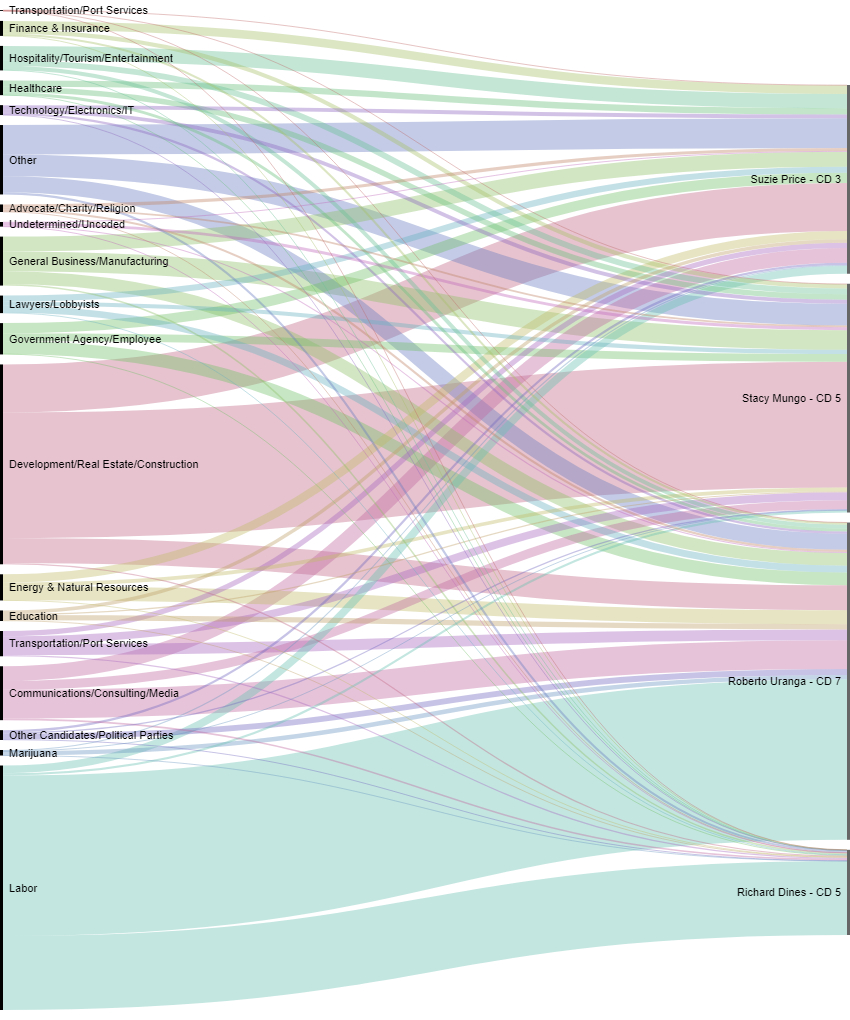

5 minute readThe 4 City Council Candidates With Most Contributions + PAC Indie Expenditures in their Favor

Methodology: The figures in the above chart include contributions to campaigns and officeholder accounts (for incumbents) over $100, as well as independent expenditures by Political Action Committees (PACs) in support of a candidate. We closely modeled our industry categories on the federal government’s Standard Industrial Classification codes, with some modifications to highlight prominent local industries. Other includes: military, homemaker, retired, not employed, student, trusts, and artists.

As voters head to the polls today, Part Two of our deep dive into money in the 2018 Long Beach municipal elections takes a closer look at the overpowering influence PACs had on one district race, and a potentially unfair campaign donation practice we observed by analyzing disclosure forms from this cycle.

You can find Part One on the mayoral race here.

The closest race today is expected to be in Council District Five, so we decided to focus there.

PACs supporting Councilmember Stacy Mungo and opponent Richard Dines duked it out in this district, spending over a hundred thousand dollars trying to influence the race.

In Mungo’s corner were PACs mainly representing real estate interests, such as the National Association of Realtors Fund and the Long Beach Neighborhood PAC, which combined spent about $51,500 on mailers and online ads boosting the incumbent. Mungo most recently tamped down efforts to bring more density to the Eastside by way of the Land Use Element in a time of critical housing need in the city. Instead she chose to side with a vocal minority whose baseless claims about density were subsequently codified into long-standing policy by the council.

Dines, a former Port of Long Beach Harbor Commissioner and active member of the International Longshore and Warehouse Union (ILWU), benefited from $50,000 in independent expenditures from a variety of union-funded PACs — including the AFL-CIO — to support his platform of increased city transparency and fiscal responsibility.

Included in that sum is a late-in-the-game barrage of $37,000 worth of mailers in the month leading up to the election from the deceptively-named Long Beach Public Safety to Support Dines for City Council 2018. Despite its name, the PAC is fully funded by labor interests.

PACs did not make independent expenditures in favor of the only other candidate vying for this office, Corliss Lee. Lee’s campaign raised a total of $9,632.

In total, independent expenditures by PACs ($101,434) in this race nearly matched the expenditures made by all Fifth District City Council campaigns combined ($123,512).

This ratio underscores the immense power PACs have to essentially cancel out constituent voices with their vast war chests whenever they choose to rain down on a municipal race. PACs, which are supposed to operate independent from candidates, have no limits on how much money they can receive and spend in a given election.

Tomisin Oluwole

Coquette

Acrylic on canvas

18 x 24 inches

Click here to check out our interview with Tomisin Oluwole, a a literary and visual artist based in Long Beach.

Instead of gunking up our site with ads, we use this space to display and promote the work of local artists.

While PACs bankrolled by unfettered union and corporate cash won’t be going anywhere until the Buckley v. Valeo Supreme Court decision is overturned or overridden by Congress, our analysis of Long Beach campaign finance data found another area where the city could improve its election fairness.

Some individual contributors were able to skirt Long Beach’s own contribution limit of $400 for City Council races by funneling additional money into campaigns though hard-to-trace companies or other entities they control.

For example, Kristie Pabst donated $400 under her name in 2017 to Mungo’s re-election campaign. Another $650 was donated the same year to the same campaign by Pabst, Kinney & Associates, the property management company Kristie owns. It is not clear why the company was allowed to exceed the donor limit by $250.

Then in early-2018, three companies, PK Freeman LTD, PK Temple LTD, and PK Wilton LTD donated $400 each to Mungo. Those three companies list Pabst Real Estate Holdings, LLC as their sole partner of which Kristie is the manager, according to documents filed with the California Secretary of State. A grand total of $2,250 was donated by Kristie and either entities under her control or associated with her, more than five times what an individual is allowed.

Because of the murky nature of incorporated businesses and limited liability companies, it can be difficult-to-impossible to trace money that is allowed to flow from them into a campaign; and because LLCs and corporations are treated as separate “persons,” it is a loophole easily exploitable by the wealthy to make multiple, sometimes anonymous, contributions.

A similar scheme played out with another Mungo donor, burger magnate Chris Vovos, who donated $400 himself and then another $400 under Tam’s Super Burgers Inc., for which he is listed as an officer in public records. Tam’s Super Burgers #42 and Tam’s Super Burgers No. 27 also show up on campaign finance disclosure forms as having donated the maximum to Mungo, but we could not verify their ownership.

We also found instances of these practices by contributors to Councilmember Suzie Price’s re-election campaign (as well as Mayor Garcia’s campaign, which we outlined in Part One).

In order to avoid this type of concealment, San Diego has banned campaign contributions from certain non-individual entities, such as corporations. In 2012, a federal judge upheld the rule writing that the “complete prohibition on direct corporate contributions is justified by the City’s important anti-corruption and anti-circumvention interests.”

A prohibition like this would be wise for Long Beach lawmakers to consider in order to limit the dark money entering our local elections and drowning out actual constituent needs. Or at the very least, increase the reporting transparency requirements for contributions coming from our fellow corporate sapiens, so that we can properly enforce the regulations we already have on the books.

Polls are open throughout the city until 8 p.m. today.

If you want to continue seeing this type of reporting from FORTHE, please consider donating by clicking the button at the top of the page.

An earlier version of this story named Stanley Dressler as a candidate for the Fifth District City Council seat. He dropped out of the race on Jan. 9. We regret the error.

kevin@forthe.org

kevin@forthe.org @reporterkflores

@reporterkflores