Downtown Developer Pays Quarter Million Dollar Settlement to Former Tenants Left Homeless in Bid to Build Luxury Apartments

7 minute readTwelve former tenants of a two-story apartment building near downtown received a settlement totaling $275,000 after filing a lawsuit accusing their ex-landlord of failing to maintain habitable living conditions at the property.

According to the lawsuit, filed in LA County Superior Court, the former tenants alleged that they repeatedly complained about vermin infestations, electrical deficiencies, mold, a lack of hot water, and other issues, but that nothing was done by Leeward Capital of Long Beach LLC, the company that owned the building.

Leeward Capital purchased the nearly century-old building at 1101 Long Beach Blvd. in 2017 and racked up scores of code enforcement violations and fines the following year, city records show.

“They didn’t have hot water. Gas was shut off. Nothing was maintained, no maintenance whatsoever. The interior was pretty bad,” said Christofer Chapman, one of the attorneys who represented the former tenants. “Leeward Capital purchased the building with the notion that they’re going to take it down and use the land to rebuild. So from the get-go, they really never did anything at all.”

The company ignored the code enforcement citations and the case was eventually referred to the prosecutor’s office and liens were placed on the property.

In the meantime, Leeward Capital began attempting to evict tenants, which according to Chapman, was done sloppily and without following proper legal procedures. He said one night, on Feb. 26, 2019, company representatives showed up to the building with Long Beach police officers in tow. The officers threw out the tenants inside while contractors began boarding up windows and removing doors.

According to an LBPD call log from that night, one company representative told police that “all tenants who legally lived at the location had been evicted, but … as soon as legal tenants were evicted, transient trespassers would illegally break into the abandoned apartments.”

Chapman said that wasn’t entirely true and after he and another tenant rights attorney intervened, the occupants of the building were allowed to stay until things could be sorted out.

“[The police] kept asking for evidence that there were actual tenants [in the building],” said Chapman. “And I said, ‘You can’t expect to have this kind of proof. This is a subject of trial and discovery and the exchange of documents.’ It turns out, some of them actually had lease agreements. And they were never evicted legally.”

But by March 2019, all of the tenants had been evicted and forced out with the help of City Prosecutor Doug Haubert, who issued a letter threatening anyone who remained at the property with arrest.

“[Leeward Capital] didn’t follow the process. They tried to run roughshod over everybody there. And in part, even with the city’s consent and participation,” said Chapman.

Some of the tenants who were pushed out were left homeless, including Stacy Schneider and Sharon Tate, who were forced to live in a motel for about half a year before finding housing.

Others, Chapman said, remain homeless to this day.

By April 2019, Leeward Capital had begun demolishing the apartment building, with plans to construct a 120-unit luxury apartment complex on the lot, where a one-bedroom unit would go for up to $3,000 a month. However, the company began demolition without the proper permit and was fined by the city, said Richard de la Torre, a spokesperson for the Development Services Department.

Tomisin Oluwole

Coquette

Acrylic on canvas

18 x 24 inches

Click here to check out our interview with Tomisin Oluwole, a a literary and visual artist based in Long Beach.

Instead of gunking up our site with ads, we use this space to display and promote the work of local artists.

Then in the early morning of April 5, 2019, the vacant, partially demolished building caught fire and was badly damaged. The fire report lists the cause of the fire as undetermined.

The charred remains of the building were eventually torn down and today, two years later, the lot sits empty.

The parties reached a settlement last year with roughly $117,500 of it going to attorney fees and costs and the remaining $157,085 split up among the 12 plaintiffs, two of whom are minors, according to court documents.

“I’m happy,” said Schneider of the settlement. “They really deserved to get busted. Leeward Capital made things worse.”

The settlement provides compensation for breach of contract, medical expenses, property damage, and other out-of-pocket costs the plaintiffs incurred as a result of living at the building.

The minors in this case also suffered bug bites and allergy type symptoms, such as runny noses, coughs, and itchy eyes, court documents state.

Leeward Capital fully denied the tenants’ allegations in court and claimed that they were squatters. The company also said they never received complaints about the condition of the building and that if any defects existed, they were minor and caused by the plaintiffs.

The managing member of Leeward Capital is Barry Alan Beitler, who did not respond to a request for comment sent via email.

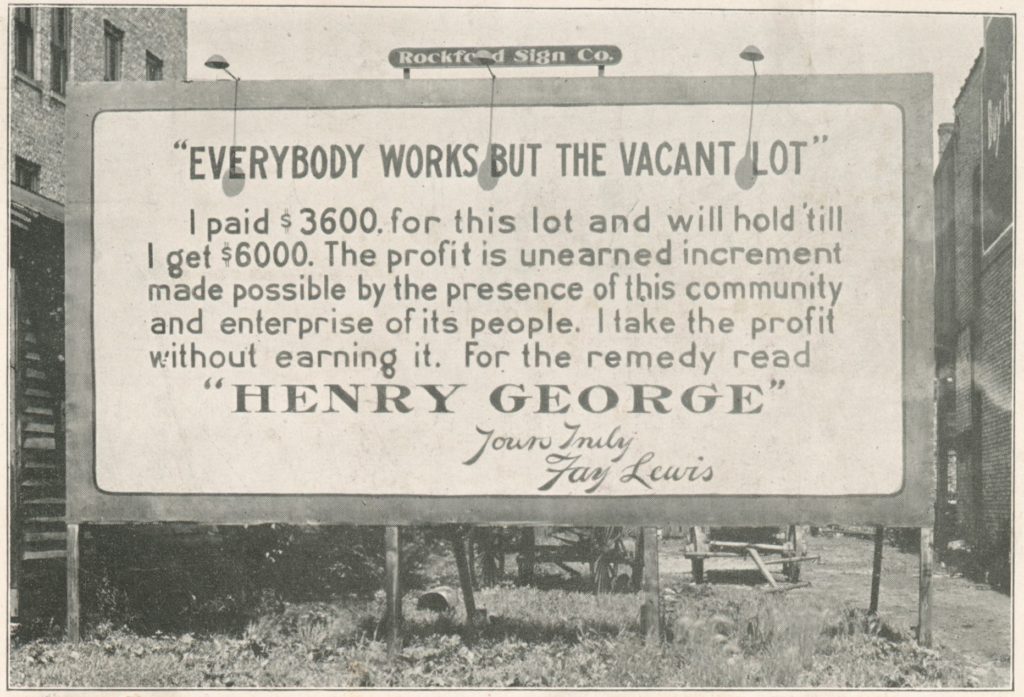

He was recently interviewed for a podcast in which he said, “The ownership of real estate is the greatest thing there is. Nothing like getting a check on the first of the month and not having to work for it.”

Beitler is heavily involved in real estate across Southern California, including in Long Beach. He is a managing partner at investment firm Pacific Property Partners, and is the founder of Beitler Commercial Realty Services, a brokerage company that specializes in real estate deals for the entertainment industry.

According to county assessor records, he owns the 13-story historic Security Pacific National Bank building on Pine Avenue in downtown, with plans to convert it into a hotel. He also owns a nearby parking garage that Pacific Property Partners had hoped to turn into a 38-story hotel. However, the pandemic has thrown those plans into uncertainty.

Campaign finance records show that Leeward Capital donated $800 to Mayor Robert Garcia’s 2018 reelection campaign, and in 2019, Christopher Atkinson, Beitler’s partner at Pacific Property Partners, gave Haubert’s officeholder account $100.

Chapman said the story of 1101 Long Beach Blvd. is emblematic of the wave of gentrification and displacement that was unleashed by the City Council’s adoption of the Downtown Plan in 2012, which loosened and streamlined development regulations in the city’s core, unleashing billions of dollars in projects without establishing renter protections until years later.

“It’s all part of the redevelopment zone. I think it was anticipated that 20,000 to 30,000 people would be relocated from the downtown area,” he said. “And so this is part of that whole process, and I see it going on and on and on. It’s still going on.”

kevin@forthe.org

kevin@forthe.org @reporterkflores

@reporterkflores