Inside the Huntington Beach-Long Beach Amazon HQ2 Proposal

The city kept the proposal a secret from the public until Long Beach-Huntington Beach were eliminated from the running

4 minute read1/27/18 This story was updated to reflect new information about the cost of producing the HBLB proposal.

The cities of Long Beach and Huntington Beach didn’t make the cut for Amazon’s massive “HQ2” campus, but a look inside their joint proposal may offer a glimpse into what incentives officials are willing to fork over to large companies looking to build or relocate here in the future.

The city kept the proposal a secret from the public until Long Beach-Huntington Beach were eliminated from the running. Officials said that the disclosure of the bid would “adversely affect [the city’s] chances of ultimately being awarded a contract by Amazon.”

It should be noted that Long Beach is still part of a Los Angeles County Economic Development Corporation nine-site bid that was chosen as a finalist by Amazon, though the proposal has not been made public.

FORTHE Media obtained the “HBLB” proposal Friday after Amazon announced Long Beach wasn’t one of the 20 cities the Seattle-based mega-retailer was still considering as a home for its second national headquarters and 50,000 new employees.

The 128-page proposal paints a portrait of a surf-and-turf lifestyle dubbed “Amazon Coast,” and envisioned a three-part campus for HQ2 in the Southland, with one site in Huntington Beach and two sites in Long Beach.

The Long Beach sites would include a cluster of three downtown buildings (District 2) dubbed “Amazon Sea” and a former Boeing property on Wardlow Road near the Long Beach Airport (District 5) dubbed “Amazon Air.” A total of about 80 acres of real estate.

Even combined, the two cities fell short of the one million person population requirement listed in the request for proposal put out by Amazon on Sept. 7.

The HBLB proposal was accompanied by an online promo video featuring surfer Brett Simpson and a custom-made surfboard that was delivered to Amazon with the proposal.

The city of Long Beach paid $28,825 for services related to the production of the proposal to ad agency interTrend Communications and to consulting firm Michael Baker International.

To sweeten the deal for the $500 billion company, various tax abatements or diversion agreements were put forth by the cities. The figures are mostly estimates based on various assumptions about the economic impact Amazon would have had on the area.

The Long Beach-specific benefits include:

–The creation of a tax increment financing district around the Wardlow site that would capture future property taxes associated with an increase of real estate value from the HQ2 development and return up to $28 million of it to Amazon. This would essentially allow the company to pay property taxes to itself.

Tomisin Oluwole

Dine with Me, 2022

Acrylic on canvas

36 x 24 inches

Click here to check out our interview with Tomisin Oluwole, a literary and visual artist based in Long Beach.

Instead of gunking up our site with ads, we use this space to display and promote the work of local artists.

–A transient occupancy tax investment agreement that would redirect an estimated $4.65 million of hotel bed taxes over a decade to Amazon as a subsidy or to fund Amazon-centric projects.

–A sales tax sharing agreement between both cities and Amazon that would return $3.65 million yearly to the retailer as a subsidy from the cities’ combined sales tax funds.

–A vague plan to reimburse Amazon with a share of taxes collected from the company’s construction, machinery, and equipment purchases. It is unclear how this would dovetail with the sales tax sharing agreement.

In addition, a report from the California governor’s office said Amazon could claim up to $300 million in tax breaks from the state, Reuters reported in October.

“Please note the incentives itemized in the proposal are an illustrative sampling of potential incentives and do not represent an exhaustive list,” the HBLB proposal states and goes on to say that any local incentive programs offered to Amazon would first need to be approved by the city council.

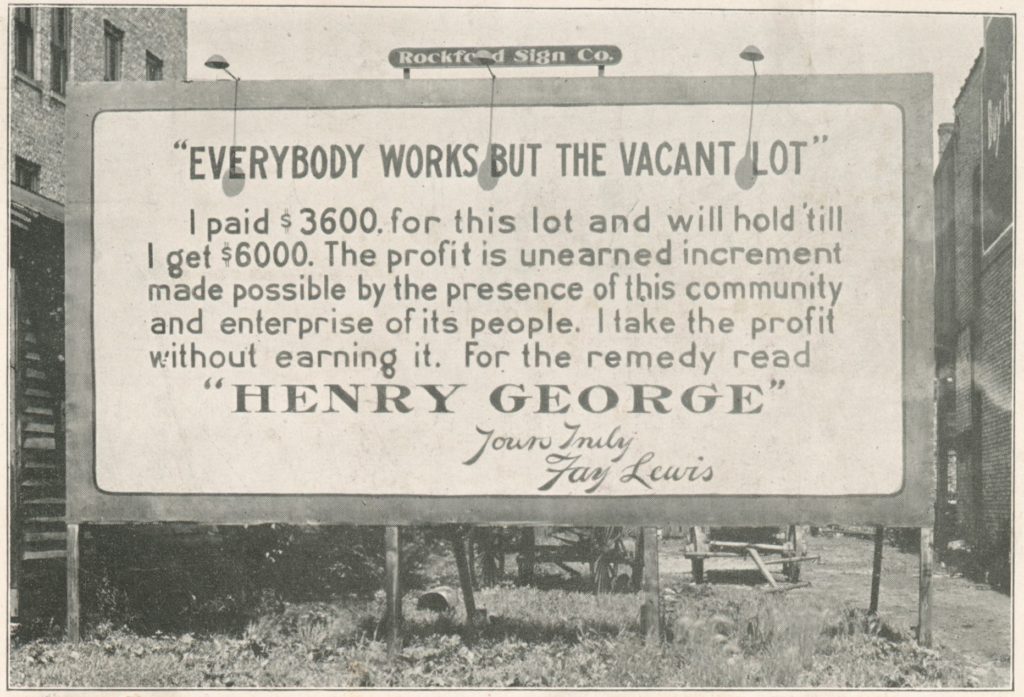

But even the thought of such handouts signals the amount of public money the city is willing to allow a wealthy corporation to cede control over in the name of job creation. Many of the features the city proudly touts in the HBLB proposal, such as public transportation and education, are institutions and services supported by taxes that Amazon would not have had to pay into had this deal gone through.

The bid was also put together amid projections that the city of Long Beach will have a $15.6 million budget deficit in 2019, when the first phase of construction on HQ2 would have begun.

It is also relevant to note that these incentive offers come as the city is currently experiencing a boon of investment and with it rapid gentrification, making it almost certain that Amazon’s won’t be the last race-to-the-bottom bidding war Long Beach enters.

Below is the full proposal.

HBLB Amazon Proposal by FORTHE Media on Scribd

kevin@forthe.org

kevin@forthe.org @reporterkflores

@reporterkflores