The Other Side of the Relief Coin: An Open Letter to the Long Beach City Council Concerning COVID-19 Rent and Mortgage Relief

10 minute readThe views expressed in this article do not necessarily reflect the views of FORTHE Media.

Many of us urged the City Council to cancel mortgages and rents over three months ago, before the COVID-19 relief plan was implemented. All the arguments we made still stand, and the need in our community is still present, as the City Council goes back to vote again on this issue.

This Tuesday, June 23, the City Council will consider requiring back pay starting August 1, with only a year to pay back all rent missed during the crisis.

This open letter to the City Council was originally written prior to the relief plan’s passage, and it argues that requiring back pay is not good enough.

Instead, we must cancel rent and cancel mortgage.

Anything less is not a bailout for the people, but a bailout for the banks.

Dear City Council,

At Tuesday’s meeting, you correctly spent a majority of your time discussing agenda item 27, dealing primarily with a potential economic relief package for Long Beach residents during the ongoing crisis related to COVID-19. I would like to focus on one particular element of the proposed package, with the hope that you, and city staff, will have time to consider my comments as you respond to this daily-evolving situation.

I believe our city, at this time, needs a straight-forward temporary relief of rent/mortgage obligations until the emergency declaration is over, and that, crucially, this should be done without forcing residents who have been affected by the virus—whether they be tenants, homeowners, business owners, or property owners—to later produce back payment.

While the city must abide by all state and federal laws, including the Constitution, it should explore all possibilities here: whether you can find a way to forgive back payment outright at the municipal level using your own emergency powers, or work with the California government to encourage such legislation, or declare that failure to pay owed funds from the crisis is not a legal reason for eviction or foreclosure, or begin now to develop a city or state fund to help residents produce back pay when it is due—there are tools available to the city to address this situation, and I urge you to please look into them. Your power on the council can work to influence other cities, and even the governor, to see this crisis in a new light.

I fear anything less would not only make other relief efforts less effective, but could also lengthen the period of suffering for many Long Beach communities, even after the pandemic has passed.

Certainly Long Beach residents barely affording their bills before the emergency could find themselves in a worse situation after. On Tuesday, one of the proposers of the economic relief package, Councilmember Rex Richardson, began his comments by correctly observing, “This emergency has exacerbated our current housing crisis.”

Richardson is right. I was evicted from my East Village Arts District studio last summer—after Long Beach’s tenant relocation ordinance was passed, but before it took effect—so that the property could be turned into a hotel; and after spending the last seven months in a precarious, temporary situation—living out of boxes, with half of my belongings stored somewhere else entirely, unable to save enough money to move to a proper place—my job of two years announced it was furloughing all staff due to business demands related to COVID-19.

With no income, little savings, a sudden lack of a job, and questions as to how I could possibly continue affording rent, I am now in the process of packing up once again—though at least this time everything is already boxed up—to leave Long Beach entirely until the emergency is over. While the epidemic has acted as the final nail, Richardson is right to point out that our city’s housing issues have existed since long before the coronavirus.

The Councilmember then went on to explain that if the city places a moratorium on evictions, they have to follow that by asking about the impacts of missed rents on property owners. Thus, Richardson also suggested a moratorium on mortgages and, to that effect, the relief package proposed city staff find ways to work “with financial institutions and lenders to prohibit foreclosures or halt mortgage payments…”

This makes perfect sense to me. Not only should homeowners be granted the same relief as tenants, we should also keep in mind that missed rental payments would make it more difficult for property owners to meet whatever mortgage obligations they may have.

I am grateful to Richardson, and the other agendizers of the item, for putting this forward so quickly, and thankful for the council’s unanimous approval. However, I was disappointed to hear that the relief package would require back payment. Specifically, tenants would have up to six months after the emergency declaration is lifted to repay the amount they could not pay due to the outbreak.

This approach falls in line with what Los Angeles Mayor Eric Garcetti has proposed: temporary relief—a grace period—followed by an obligation for residents to pay owed funds once the crisis has passed. San Francisco is taking the same approach for renters facing eviction, as is Santa Monica, San Jose, and more.

Tomisin Oluwole

Ode to Pink II, 2020

Acrylic and marker on paper

14 x 22 inches

Click here to check out our interview with Tomisin Oluwole, a a literary and visual artist based in Long Beach.

Instead of gunking up our site with ads, we use this space to display and promote the work of local artists.

Gov. Gavin Newsom issued an executive order on Monday clearing the way for cities like Long Beach, and others mentioned above, to address these issues locally—but also made sure to note, “Nothing in this Order shall… restrict a landlord’s ability to collect rent due.”

The Governor of New York, Andrew Cuomo, on Thursday went so far as to suspend mortgage payments—but also made sure to clarify, “We’re not exempting people from the mortgage payments. We’re just adjusting the mortgage to include those payments on the back end.”

Even the federal government has postponed certain mortgage obligations and placed a moratorium on evictions related to them—but with the caveat that missed payments must eventually be paid.

While all temporary relief is incredibly needed, and should be pursued immediately, the requirement of back payment is unwarranted given this unprecedented situation. I worry about how our city would be impacted if ten or twelve months from now residents here owed double the rent—or double the mortgage.

Though, we should not equate the two completely: missed mortgage payments will likely be amortized through the remainder of the loan, while renters may face their new financial burden more immediately, and all at once. Would the council consider working to amortize rent, and utilities, through a longer period of time as well?

It may also help to consider these issues the other way around: if the city does not move quickly and firmly to temporarily forgive rent and mortgage payments outright, what will happen?

One possibility is that the government will have to step in even more aggressively to provide aid. Unfortunately, a significant part of any financial relief the government offers would be passed from the hands of tenants/homeowners/businesses to private banks in the form of rent/mortgage—either now, or in the future when any back payment is due.

For instance, various proposals have been made, including by the White House, to directly give cash to some individuals in relief. Though it is still being debated, it could take the form of two checks of $1,000 for Americans beneath a certain income bracket. But this, like any other proposed relief, will be much less effective than it could be if it fails to include a moratorium of the kind proposed in this letter, since many working families will have to use all or part of the money for mortgage or for rent—meaning, whatever our intentions, such a stimulus plan is less a handout to working Americans, and more a handout to private banks.

How can this be avoided? I would argue that the only way to keep the benefits meant for Americans—or the people of Long Beach—in the hands of those who they were meant for, is to establish a strategy for minimizing the amount of back pay however we can.

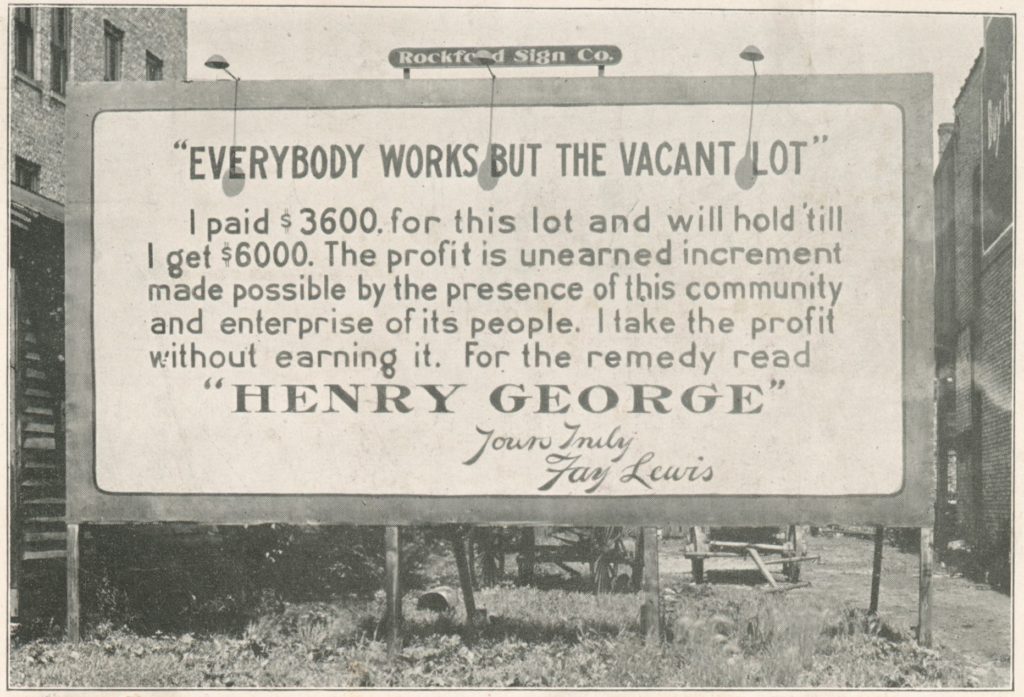

Another factor—which worries me greatly—is that, beyond government intervention, the other side of the relief coin during this crisis could come from those same private banks, but in a way that would yet again enhance or safeguard their profits.

The way American monetary policy at present functions is for quick injections of cash to largely take the form of an easing of lending standards, which ultimately benefits banks. The Fed, for its part, has already cut interest rates to zero to give the nation’s banks easier access to credit. Will people feel forced to take on loans just to afford food so they can clear up other funds to pay their mortgage—either today, or tomorrow when back pay is due?

I find it scary to imagine any Long Beach residents having to borrow money with interest from a bank so they can afford to pay their mortgage to a bank.

A list of statements from sources within several American banks confirms a strategy of mere forbearance—postponing pay until better times return, much like the strategy now being pursued by cities and states across the country. When pressed on whether a plan to suspend mortgage payments during the crisis could work in America, a senior economist from Wells Fargo instead chose to worry about the bonds, asking “Who is going to make those interest payments?”

That is simply not a good enough response coming from our nation’s banking institutions, which have tremendous power and wealth, and should thus be bearing more of the financial burden. Previously agreed upon contracts should not be leveraged to an unfair and unaccounted for degree to exploit hundreds of thousands of Long Beach residents. I would argue no one is truly getting the home they agreed to pay for when that home becomes a quarantine.

To mitigate or eliminate these problems, I believe you must work towards minimizing back pay, in whatever way is most feasible for the city at this time. I fear any lesser move would only punt the issues I have raised further down the road, and that we could arrive on the other side of the COVID-19 epidemic only to find ourselves stuck with an even bigger bill, spawning yet another emergency, and mandating even further intervention.

In the spirit of democracy, collaboration, and shared prosperity, and for an end to exploitation, I thank you for your time.

The words in this letter belong solely to the author—but I hope you won’t let it stay that way. Reach out to me with ideas for art, stories, perspectives, solutions, and new politics: andrew@forthe.org. Alternatively, DM me on Instagram if that is more convenient: @oldschoolcarroll; or Twitter: @abolishprop13.

andrew@forthe.org

andrew@forthe.org