Universal Basic Income—Take the Power Back: How to Truly Fund a UBI (Part 3)

23 minute readThe following is a three-part series on what a Universal Basic Income (UBI) in Long Beach could mean for the city, its residents, its politicians, and the wider nation.

In Part One, we explored the basics: What is a UBI? Who supports it? Why? What might the city’s proposed pilot version look like? And how do supporters hope to fund the program?

Yesterday, in Part Two, we explored the local context: What does the mayor’s support of a UBI mean? Can he be trusted with it? And how does this relate to the rest of his record?

And today, in Part Three, we will explore the ideal: How should we fund a basic income? Why? And what could this mean for our city and our world?

PART THREE

HOW SHOULD WE FUND IT?

Let’s say we have a chance to play this game in sandbox mode. If we could fund a Universal Basic Income (UBI) any way we wanted, how would we do it?

Well, I have a few suggestions for the city as it enters this new world, so that ideally what we come up with is not a pilot program that relies on grants and private charity. In my opinion, running a pilot is the perfect chance to actually run a pilot. Mayor Robert Garcia seems content to just accept money from Twitter CEO Jack Dorsey and hand it out for a few months while the city monitors what folks spend it on. But where’s the innovation in that? Charity has existed for millenia, and it has yet to solve poverty.

So I say the city should run a pilot not just on the distribution, but also on the funding. This would be more difficult logistically and politically, and would require more debate, more conversation, more education, and more hard work. But that’s a good thing. Ending poverty will take exactly all those things and more. Even if the thought experiment outlined in the rest of this essay cannot be implemented exactly, the concepts and insights behind it could still prove useful to the city as we design the most effective UBI we can achieve, instead of settling for the most convenient one possible.

LAND AND LIBERTY

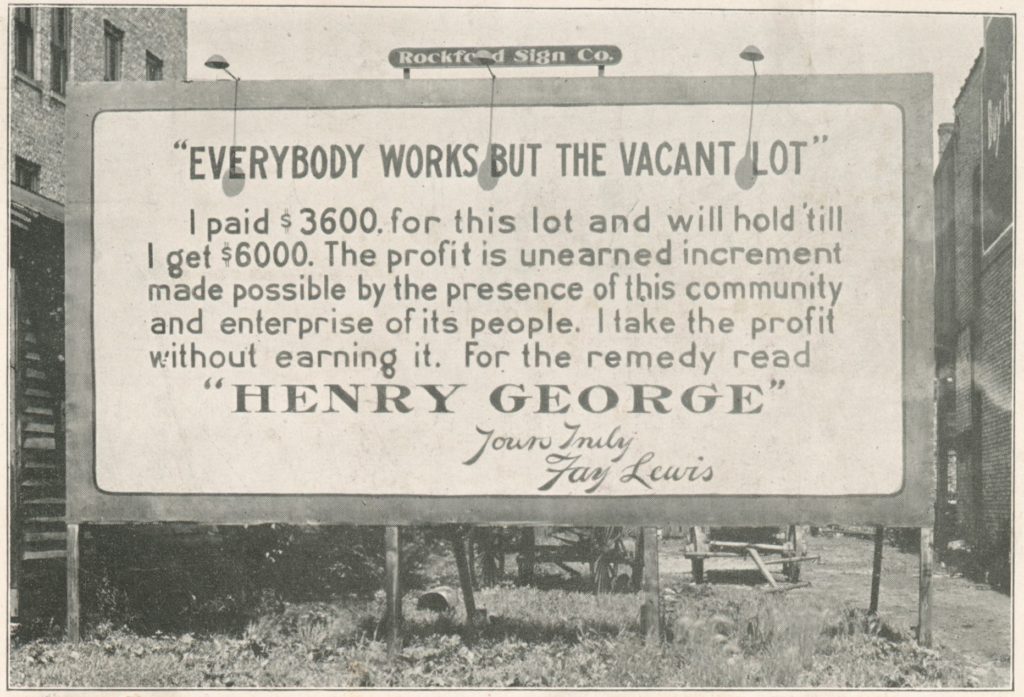

A UBI, when done well, could liberate wide swaths of normal, hard-working people from two of the most fundamental causes of poverty: high rents/mortgages and low wages. The UBI could improve both areas at the same time by utilising the synergistic relationships between them. The best way to do this would be to go back to the original insight of Thomas Paine in his 1797 essay, “Agrarian Justice,” and fund it by taxing land values and other natural resources and the monopoly rents derived therefrom.

Paine understood that rent was the most natural source for funding such a program because the earth rightfully belongs to everyone, no matter where they are born or what class they are born into. Therefore it makes sense to let individuals own whatever is built on top of the land—front yards, factories, farms, homes, skyscrapers, etc.—but the land itself should always be held commonly and its value distributed to all people as compensation for what they can no longer access.

Paine also understood that as society developed, or as good governance increased, the value of land went up—and that this was not because of the landowner per se, but rather from all of the community collaborating to build a better society. Land value, by definition, is created by all of us, so why shouldn’t we distribute its value to all of us?

As Paine writes: “Every proprietor, therefore… owes to the community a groundrent (for I know of no better term to express the idea) for the land which they hold; and it is from this groundrent that the [basic income] fund proposed in this plan is to issue.”

It turns out there are several sources for taxing “groundrent.” Long Beach is situated on the coast and has an international port, for example, so we are wealthier in terms of natural resources than many other places. But we also bear the consequences of that port—and some residents bear it more than others. Shouldn’t they benefit economically, or at least be compensated? Why not pilot a clever Pigouvian tax on the port, and distribute the funds directly to the people who suffer the most from neighboring it?

Certainly any such public or natural resource that is already being utilized should be taxed as much as possible, so that the revenue it generates is never privatized, but consistently captured and recycled into public hands. Nor should any of these resources ever, ever be sold; and nor should any untapped resource suddenly now be exploited. Instead, we should look to existing resources that are privately held, but which are natural resources that rightfully belong to the public. Tax those resources, and earmark the funds to the UBI.

Luckily, Long Beach already has the perfect resource that meets all of this criteria; a natural resource that is already being tapped by private interests, and yet it is not being heavily taxed. That resource? Real estate.

Think about the life expectancy gap between east and west Long Beach. There is a parallel gap in the cost of real estate between east and west Long Beach. That’s because, somewhat obviously, people will pay more money to live longer/better/healthier lives, if they can afford it. Through the rest of this essay, we will explore this very simple observation further, helping us understand the UBI in a totally different light. Instead of viewing basic income as a modernized form of charity, we can use the policy to compensate folks who are priced out of one area by taxing the land value of the areas they are priced out of. This would effectively turn rents and mortgages on their heads, reversing them from a payment you make to the banks, into a payment you make to the people you are excluding from your property. Rents and mortgages would become the price tag for exclusivity, and you would purchase that right from the rest of the human race quite literally: they each receive what you pay in, making all of us the true owners of the earth.

Let’s explore this possibility.

WHAT IS LAND VALUE?

What Paine called “groundrent,” we now refer to as “land value” or “site value” or “location value.” It is the value of the location itself, ignoring all buildings and improvements and activities directly on top of it.

For instance, locations on the east side of Long Beach have, generally speaking, better parks, more parks, fresher air, more space, better sidewalks, better streets, more trees, less pollution, better schools, better representation in local government, etc., etc. As a result, they tend to have higher “location value,” which also means that rents/mortgages tend to be higher for those locations.

Any one location might then also have a particularly nice house on top of it, or multiple bathrooms inside, or a new paint job, or pretty flowers in the front yard. All those amenities would raise the value of the property, but not affect the location value itself, which is determined by ignoring all improvements and focusing only on the value derived from everything happening around the location. When the value of a property goes up even though nothing on top of it has changed, that’s location value at work.

As we all know through experience, the benefits one location has over another are the product of many, many communal, geographical, political, and historical factors, from sources as conscious and intentional as red-lining, to ones as natural as sunshine; from influences as immediate as exclusive zoning, to influences dating back centuries, such as the genocides and enslavements that allowed land to be settled by the ancestors of those who still benefit. Recognizing the complicated and varied sources from which locations get value makes it easy to see that the value of a location should not belong to the landowner, since they did not create the value.

Take, for instance, a more simple and less historical example: the parking lot that now stands in the middle of Broadway, 3rd Street, Pine Avenue, and the Promenade. That parking lot, despite having almost nothing on top of it, actually still has a lot of economic value. That value is in large part derived from its amazing location. Whenever anything around that location improves, the value of the location also improves, meaning the lot could sell for more on the private market. When the general economy improves, the value of the location also improves. If interest rates go down and there is more easy credit available for folks to make big purchases with, the value of the location improves even more—and, again, this means it could sell for more on the private market despite nothing on top of it having changed a bit.

If tomorrow, the sun decided it was going to shine 365 days a year in Wyoming, and Southern California was plunged into a windy, frozen tundra, that parking lot might not be worth as much. Its owner might even abandon it. Meanwhile, land in Wyoming would suddenly be a hot commodity (literally).

This process of land getting its value from all sorts of random and not-so-random factors is central to gentrification; it the same process by which public works projects and neighborhood “improvements” tend to raise rents in the area, and subsequently price out the folks who were ostensibly meant to benefit from the changes.

All a tax on “location value” means in this context is that when the value of a lot goes up because of the activities happening around that lot—whether they be sunshine, easy credit, or public projects—that increased value is not allowed to go to the landowner (who has clearly done nothing for it), and instead goes to the public. The growing economic field of “value capture” uses this fundamental insight to capture public spending, sending it back to the public, by recognizing that public projects raise location values in the areas around the project. This mechanism is exactly what should be used to fund a UBI.

THE BEST TAX

That’s what “location” means in this context, and all locations on earth have such a “location value.” Location value is, by definition, unearned. Taxing location value just means taxing the unearned value of every location. While a property tax might tax what happens on top of a property, a location tax just taxes the benefits that property receives from what happens around the property. This has many economic benefits:

- First, it is progressive, meaning those who have access to the best resources (or those who own the best locations) pay the most taxes. People paying rent/mortgage in Naples will quite simply pay more of the tax than people living west of the 710, precisely because of the different values of their locations. Put simply, you pay for the benefits you receive. The more benefits to your location, the more you pay.

- Second, it is direct, meaning it cannot be passed on—unlike, say, income and sales taxes. Whoever ultimately owns the land, pays the tax. They cannot increase demand or decrease supply to pass the tax on, so they are stuck with it.

- Third, it is what economists call “non-distortionary,” meaning it doesn’t disincentivize productive economic behavior. In fact, quite the opposite: it punishes unproductive land-hoarding, speculation, and absentee landlordism.

- And fourth, it is transparent—unlike cash, you cannot pick up a location on the earth and hide it in a Swiss bank account or pretend its address is in Delaware. The location is right there. We can see it.

So who would bear the burden of this tax? In the long-run, mainly banks, which own the earth through the mortgage system. Bank income from mortgages would steadily be replaced in time by tax income for the government, which would then fund the UBI.

As we are all very aware now due to the pandemic, property managers at the local level need renters to pay their rent each month because property managers are themselves just serfs, and they owe tribute to the banks. Likewise, homeowners do not really own their homes, but are paying rent to access a home that the bank owns. We call their rent a “mortgage.” When economic downturns produce record foreclosures, this true ownership structure becomes very obvious. Homeowners are not all that different from renters, and “the middle class” is not an empirical concept, just an ideological one.

It is the banks which own most of the earth, and the banks will therefore foot the bill of a tax on the earth. By taxing the stuff beneath our feet, we actually tax the highest reaches of privilege and power.

NO MORE BOOMS AND BUSTS

Tomisin Oluwole

Coquette

Acrylic on canvas

18 x 24 inches

Click here to check out our interview with Tomisin Oluwole, a a literary and visual artist based in Long Beach.

Instead of gunking up our site with ads, we use this space to display and promote the work of local artists.

Other taxes tend to increase the cost of production, and thus increase prices, which partly explains how such taxes get “passed on,” as they say, to consumers. However, due to the monopolistic nature of land ownership, a tax on location value doesn’t work that way—in fact, quite the opposite, the tax cannot get passed on, and it also tends to put a downward or stabilizing pressure on prices. It would do this by reducing the private incentive to profit off location value, thus making land less valuable to own.

No longer would publicly-generated value be open to private markets, or available for speculation or hoarding or rent-gouging. Instead, increased rent would just mean an increased tax burden for the landowner, who would thus no longer have an interest in high rents.

In such a system, land would no longer be valuable to own. It would still be super valuable to use land, of course—it’s just that the owners of land would no longer have any reason to own it if they weren’t also using it. This could help combat absentee landlordism and slumlords. You want to profit? Do something. Provide something. Provide a service. Provide a good. Provide a livable, functional home. Provide timely repairs. Provide a welcoming environment. Invest in the property. Add a garage or remodel the kitchen, etc.

“Mom-and-pop” property managers would see increased profits in this system, as we would truly become a service economy instead of a power economy. Corporate landlords and corporate developers, on the other hand, would have to rethink their business models.

Multiple empirical studies across varying global regions have shown that there is a direct causal link between increased property taxes and decreased house price volatility, precisely because the property tax is partly a tax on location value, and taxes on location value reduce profits, and thus reduce prices, and thus reduce the wild, speculative gambling that occurs during a housing boom.

With a proper policy, we could have a basic income that not only works to cycle rents and mortgages back to people when they go up, but also helps keep rents and mortgages stable or low by reducing the profit motive embedded in the real estate industry, thus also reducing speculation, as well as the cyclical crashing of real estate and other markets.

SHARE THE RENT

Still further, such a distributive scheme has the added progressive benefit that whoever is paying the most rent to live, work, and operate their businesses in the nicest places would be pitching in the most money to the UBI’s fund. As a global example, people in Beverly Hills or the French Riviera would pay top dollar for their exclusive oases—and the money would be transferred largely to working-class peoples paying rent to live somewhere less exclusive.

Bringing it back to the local level, folks living on the eastside of Long Beach, if they continue excluding multifamily housing from their neighborhoods, would at least have to purchase that exclusivity by paying into a general fund that would then go on to provide a basic income for the very people they are excluding. That is how a basic income funded from taxing rent is simultaneously:

- Equal (everyone receives the same);

- Progressive (people pay different amounts based on how advantaged their location on the earth is, or on how valuable the locations they own are);

- Equitable (those living in less advantaged areas receive the highest net benefit—i.e., they receive the same UBI amount as everyone else, yes, but because they are paying much less into the fund due to their location, they end up with the highest net benefit).

Properly imagined, the basic income is compensation for the theft of exclusion. This, to me, is the most appropriate lens for discussing the UBI, because the issues surrounding exclusion are fundamental to its outcomes and contexts.

For instance, think about any place where a UBI might be implemented: if someone cannot afford to live there, or is imprisoned or otherwise prevented from accessing the area, then they are also denied access to the UBI. Can you imagine instituting a UBI in our community only to then turn around and displace the low-income residents who would benefit the most from it!? This would effectively price them out of the area where they were receiving the basic income.

We cannot allow such a tragedy to take place; and yet that is exactly what would happen if we don’t think this policy through. Because if a community actually had a UBI, just imagine how much more rent you’d have to pay to live in that community! A UBI could end up raising rents (and mortgages), because it’s a benefit people want to access, just as much as accessing a good school district or good air quality or good jobs is a benefit. All those things raise the value of land, and make it more expensive to live somewhere. A UBI would do the same.

We also are all aware that rents can be raised simply because there is more money in the economy. If the UBI increases the purchasing power of average folks, rents will go up simply because people have more spare change to spend on rent. It would be difficult to predict what percentage of a UBI fund would just end up in the hands of landlords/banks through rents/mortgages, but experience suggests it would be large. That is why it’s doubly important that you tax location value to pay for the UBI, so that the money is cycled back to the people, and doesn’t just end up in the hands of the banks through rents and mortgages.

And now turn to why we pay rent/mortgage: we pay it to exclude. We pay it to access a location and be able to legally say no one else can enter it without our consent. So taxing that power and redistributing the funds to everyone else means paying rent/mortgage to the people you are excluding for your power to exclude them. It is the compensation you give them for reducing their equal access to the earth. And the more valuable the resources you exclude others from, the more you have to pay them.

Exclusion is key because it plays into many other dynamics—perhaps it even forms and shapes those dynamics more than anything. Think about the role of exclusion in almost all areas of life: rent, gentrification, labor migration, education, borders, policing, resource extraction, health care access, food quality, and on and on. Exclusion is one of the building blocks of capitalism, and imagining the UBI as a congenial act of charity from happy billionaires in case the robots take our jobs away completely dodges all the important questions surrounding who is rich and why.

LOST WAGES

Another important subject, for example, that exclusion and the UBI both touch upon is wages; and it is impossible to discuss the stagnation of wages without discussing ever-rising rents.

Why do rents go up as wages, in real terms, fall? It becomes easier to understand this split once we see that rent and wages are two payments deriving from the same source: there can only be wages to pay once rent is paid.

Labor must pay rent before it can even engage in labor; just as much as business owners and employers of all kinds must pay rent before they can hire labor, or engage in their own labor to develop their own business. Likewise, places with higher wages tend to have higher rent: in other words, labor chases higher wages, but has to pay higher rent to access higher wages. Higher wages are, to at least some degree, a location-based “benefit,” just like school districts and nice weather and everything else.

Finally, rent also goes up when labor (including the labor of small business owners) improves the quality of an area. This contributes to increased location values, and yet labor does not receive that value—in fact, labor’s own efforts are turned against labor when rents (and mortgages) are increased due to the hard work of labor. The new income goes to the owner of the land (the bank), who has done nothing for it, and is merely a leach on the efforts of the rest of human society.

Economists call all of these phenomena “externalities;” socialists call them “exploitation.” I say it’s good to understand them as both; and, even better, such understanding is the rope that will pull us out of the quicksand of global poverty. If paying higher rent means there is less money in the hands of businesses to go towards wages, and if people pay higher rent to access higher wages, and if rent itself goes up partly because of the actions of labor, then rent is three times the thief of wages. Therefore, if we tax rent to pay for a basic income, we are essentially taking from rent every time it steals from working peoples, and giving the money back to working peoples as compensation for their lost wages.

That is the crucial point. A UBI is not meant to be charity. A UBI is meant to be justice. Those are your lost wages. They belong to you. So a proper UBI would reappropriate your lost wages and give them back to their rightful owner: you.

We would finally not need to struggle every generation for the most marginal of minimum wage increases. The basic income would be a fund that automatically kept pace with the cost of living—i.e., when mortgages and rents go up, the basic income goes up right along with them.

After all, increases in the cost of living are almost entirely determined by increases in the cost of mortgages and rents. After adjusting for inflation, food doesn’t tend to get dramatically more expensive, technology doesn’t tend to get dramatically more expensive, and housing doesn’t tend to get dramatically more expensive (because timber, electrical work, flooring, furniture, transportation, construction costs, etc., do not tend to get more expensive).

Instead, it is the location value underneath housing that tends to get dramatically more expensive. Hence the real estate phrase, “Location, location, location.” Houses depreciate in value over time, locations improve. So we aren’t in a housing crisis—we’re in a location crisis, we’re in a crisis of space, a crisis of access, a crisis of exclusion. And if we recycle what we pay for location (a part of rents and mortgages) back to people, we are providing a floor that automatically keeps pace with the cost of living, solving the crisis in a way no amount of building ever will.

TAKE THE POWER BACK

There are many other benefits to such a new approach to politics, economics, taxation, and wealth distribution schemes as we have outlined briefly here. The point of writing this now is, one, to help inform future discussions by showing the wide range of possible approaches to this subject; and two, to point out that such a radical way of funding the basic income itself requires a radical understanding of, and imagination for, its potential.

Would we be able to do something like this in California? Not tomorrow, no. Which is why any UBI that appears to us tomorrow should make us immediately suspicious of where it came from, how it got there, and what it was really trying to accomplish.

But could we do something like this in California in 10 years? 20 years? Definitely. Could we utilize the insights and principles behind this idea to achieve something more immediate but more limited? Sure. Could we do something close to it but slightly different, or along the same lines but with some compromises to see it to the finish line and get everyone on board? Yes.

But it will require us to work. We’ll have to get homeowners on board while also fighting the structures of home-owning, and we’ll have to get middle America on board while combating the misinformation they will be propagandized with by corporate America. (Although, the ongoing struggle between Wall Street hedge funds and retail traders buying up GameStop stock shows encouraging signs for our future struggle to dismantle the mortgage system and take profits back from the banks.)

But it won’t be as easy as asking tech daddy for money and then handing out allowances. We’ll have to educate, struggle, organize, and lead. And that is why it’s very important for us to understand what neoliberals—and their lackeys like Garcia—want with the Universal Basic Income: they want to get hold of this grand and noble idea before we do, dominate the conversations around it, ruin its potential, turn it from a hope against the excesses of capitalism into a safeguard of its growth, advertise their involvement in the most performative way possible, and then benefit from it politically and socially while claiming they accomplished a revolution.

But it’s not a revolution. It’s a counter-revolution. The UBI as imagined by elites is nothing but an appropriation that will not only keep capitalist exploitation completely untouched, but see it safely into the future that is meant to belong to us all.

andrew@forthe.org

andrew@forthe.org